When it comes to forex trading, the name FxPro often pops up as one of the more established and trusted brokers. But beyond the marketing and flashy promises, how good is FxPro really? As a real trader who’s spent time testing their platform, I’m breaking down everything you need to know before you open an account — the good, the bad, and the honest truth.

About FxPro

Founded in 2006, FxPro is a UK-based forex and CFD broker that has grown to serve traders in more than 170 countries. The company is regulated by several top-tier authorities, including the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, and the FSCA in South Africa.

That’s already a strong sign of legitimacy — regulation by reputable bodies means FxPro follows strict financial and client protection rules, which is something every trader should look for before investing a cent.

Account Types and Minimum Deposit

FxPro offers multiple account types depending on your trading style and platform preference. You can choose between MT4, MT5, cTrader, or FxPro’s proprietary platform.

- Minimum Deposit: $10 (recommended starting balance: $100+)

- Leverage: Up to 1:Unlimite

- Base Currencies: USD, EUR, GBP, and others

For beginners, FxPro also provides a demo account, which is great for practicing without risk.

What I like is the flexibility — you can start small but still access professional trading conditions as you grow.

Trading Platforms and Experience

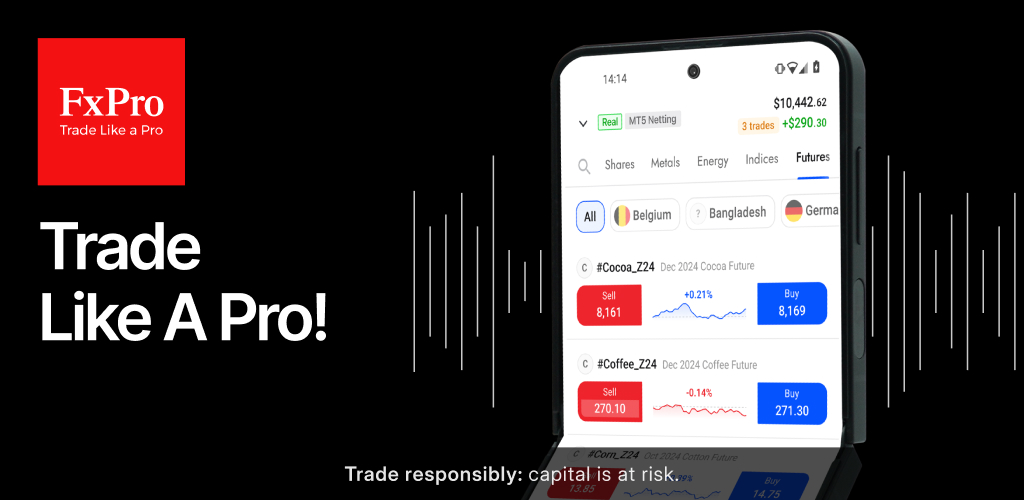

FxPro offers all the major trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

During my testing, execution speed was excellent, especially on cTrader, which offers tighter spreads and better order transparency. MT4 and MT5 are familiar and easy to use, but cTrader feels smoother and more professional if you’re into scalping or algorithmic trading.

The FxPro App is also user-friendly and surprisingly powerful. You can fund your account, trade, and monitor the markets all from one clean interface — no need to jump between multiple tools.

Spreads, Fees, and Commissions

FxPro is known for its competitive spreads, especially on the cTrader account.

Here’s what I noticed:

- EUR/USD: As low as 0.1 pips (cTrader)

- Standard Accounts: Slightly higher spreads, but no commission

- ECN Accounts (cTrader): Tight spreads + small commission per trade

There are no deposit fees, and withdrawal fees are minimal or non-existent depending on your method.

However, inactivity fees do apply if you leave your account unused for too long — something to keep in mind.

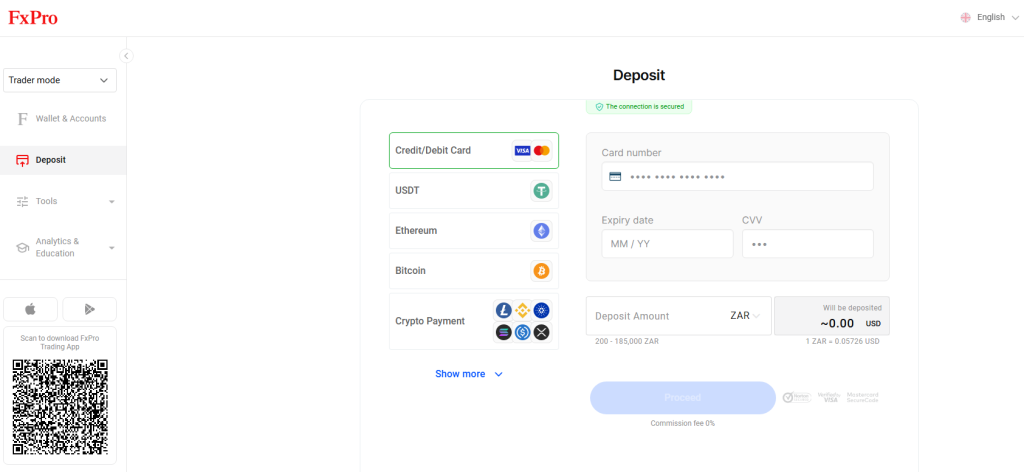

Deposits and Withdrawals

Funding your FxPro account is straightforward. They support bank transfer, debit/credit cards, PayPal, Skrill, and Neteller.

Withdrawals are processed fairly quickly — in my experience, within 1–2 business days, which is solid compared to some brokers that can take a week.

Security is also top-notch. All transactions are encrypted, and client funds are held in segregated accounts, meaning your money is separate from the company’s operational funds.

Education and Tools

FxPro does a good job offering market analysis, economic calendars, and webinars, but it’s not the most beginner-friendly broker when it comes to step-by-step learning.

If you’re new to trading, you’ll find the basics, but don’t expect a full education academy. FxPro seems to cater more to traders who already know what they’re doing and want a professional-grade experience.

Customer Support

FxPro’s support team is available 24/5 via live chat, email, and phone.

I tested their live chat and got connected in under a minute — a good sign. The staff were polite and knowledgeable, not just reading from a script.

It would be great if they offered 24/7 support, especially for traders in different time zones, but overall, it’s reliable.

Is FxPro Safe and Legit?

Absolutely. FxPro is one of the most regulated brokers in the world, with a long track record and a solid reputation.

It offers negative balance protection, so you can’t lose more than you deposit, and it’s been around long enough to prove its reliability — which is more than you can say for many brokers out there.

Pros and Cons

Pros:

✅ Strong global regulation

✅ Fast execution and reliable platforms

✅ Tight spreads on cTrader

✅ Smooth deposit and withdrawal process

✅ Great for intermediate and advanced traders

Cons:

❌ Education materials could be better

❌ Inactivity fees

❌ No 24/7 support

Final Verdict: Should You Trade with FxPro?

If you’re looking for a regulated, transparent, and professional forex broker, FxPro is one of the better options in 2025.

It’s not perfect, but it delivers where it counts — execution speed, security, and trading conditions.

For serious traders, FxPro is worth considering. For complete beginners, it might feel slightly advanced, but once you get comfortable, it’s a broker you can stick with for years.

Final Thoughts

Before signing up with FxPro, test their demo account, explore each platform, and make sure their conditions match your trading goals. A good broker can make a big difference — but only if you know how to use it wisely.

Be First to Comment